The 2021 Cattle Market Beginning Slate

Higher feed prices and lower cattle inventory to start the year.

The cattle industry, like everyone else, is more than ready to move past 2020 and into a new year. While the industry will start the year with a new slate, there are numerous factors in place that will shape markets for at least the first few months of 2021. Cattle markets face a mix of opportunities and challenges as the new year begins.

The pandemic continues and seems likely to bring the worst conditions to date in the next few months. For cattle markets, this means a continuation of a limited foodservice sector and more challenges in food product markets. Boxed-beef prices at the end of 2020 were just about exactly equal to one year earlier, but that obscures the continuing variation in foodservice and retail grocery product demands. Primal chuck and round prices were higher year over year along with ribs, while loins were down. Foodservice-dependent products continue to be noticeably affected by limited demand with, for example, prices for tenderloin down 14%; petite tender prices down 25% and brisket prices down 4%, while strip loin steaks (popular in retail grocery) are up 12% year over year. Overall beef demand has been, and continues to be, strong, but the challenges to food supply chains will continue.

Grain and oilseed prices are significantly higher than one year ago as 2021 begins. On average, cash corn prices in December 2020 were about 22% higher than one year earlier, with sorghum prices up more than 50%; wheat prices up about 30%; and soybean prices up 35% year over year. Dried distillers’ grains (DDGs) prices at the end of 2020 were roughly 39% higher than the end of 2019.

Higher feed prices mean higher feedlot ration costs and higher supplemental feed costs for stocker and cow-calf production. Cattle production will be affected by higher feed prices, not so much in terms of how much production will occur, but more in terms of how production will change. For example, higher ration costs will change feedlot demand for the type and size of feeder cattle preferred in feedlots.

At the end of 2020, 41% of the United States was experiencing some degree of drought (Drought Monitor D1-D4), mostly in the western half of the country. One year ago, the D1-D4 level in the country was less than 10%. The current level of drought is concerning and, should it persist into the coming growing season, may have significant effects rather quickly in 2021. Drought generally expanded through 2020 to encompass most of the Rocky Mountain and Western Plains regions.

Hay supplies going into 2021 appear to be adequate with a slight reduction in 2020 hay production offset by larger May 1 beginning stocks. Hay prices in late 2020 were slightly lower year over year for both alfalfa and other hay and are projected to average lower in 2021. In part, the lower price projections reflect expectations of less total hay demand as cattle numbers decline in 2021. Regional hay market conditions vary considerably and are higher than the national average prices in regions where drought is more severe. Persistent drought conditions may influence both hay demand and supply in 2021.

Cattle prices struggled through much of 2020 but ended the year with some momentum. Calf prices in Oklahoma were close to year-earlier levels at the end of December and increased nearly 20% from lows earlier in the fall. Prices for heavier feeder cattle remained about 7% below year-earlier levels at the end of the year, but similarly increased roughly 13% from fall 2020 lows. Fed-cattle prices finished the year with strength that represented a roughly 18% increase from summer lows, but were more than 8% lower year over year.

Strong beef demand and tightening cattle supplies provide cautious optimism for cattle markets in 2021. Higher feed prices and continuing drought conditions are threats to individual producers and perhaps to overall market conditions in the coming year. Consumer demand will be supported by additional federal stimulus for a time, but continuing macroeconomic challenges will persist through the year. The continuing pandemic and the time needed for vaccine implementation suggest that much of the promise of 2021 may be pushed into the second half of the year. In the meantime, uncertainty and volatility are likely to remain elevated, and risk management continues to be a key management and marketing consideration.

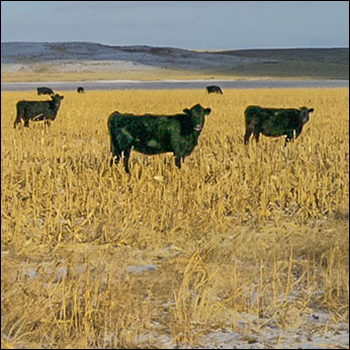

Editor’s note: This article is reprinted with permission from the Jan. 4 Cow-Calf Corner, a newsletter published by the Oklahoma Cooperative Extension Service, for which Derrell Peel is a livestock marketing specialist. Front photo by Lynae Bowman, 2020 NJAA/Angus Journal Photo Contest.